Registering a VATliable Company in Indonesia Indonesia Expat

Handling VAT Identification No. and Group VAT ID AppVision Kft.

TaxFlash Tax Indonesia / February 2022 / No. 04 Preliminary VAT refunds - an update On 30 December 2021, the Minister of Finance (MoF) issued Regulation No.PMK-2091 which provides an update on the rules for preliminary Value-Added Tax (VAT) refunds. Generally, certain VATable Entrepreneurs are eligible to request a preliminary

A Guide to Value Added Tax in Indonesia

FAQs issued by DGT for the new VAT invoice regulation. On 31 March 2022, the Directorate General of Taxation (DGT) issued regulation Number PER-03/PJ/2022 (PER-03) regarding VAT invoice (please refer to Tax Alert April 2022). Despite its objective to provide certainty as well as simplification in processing and administration around VAT invoice.

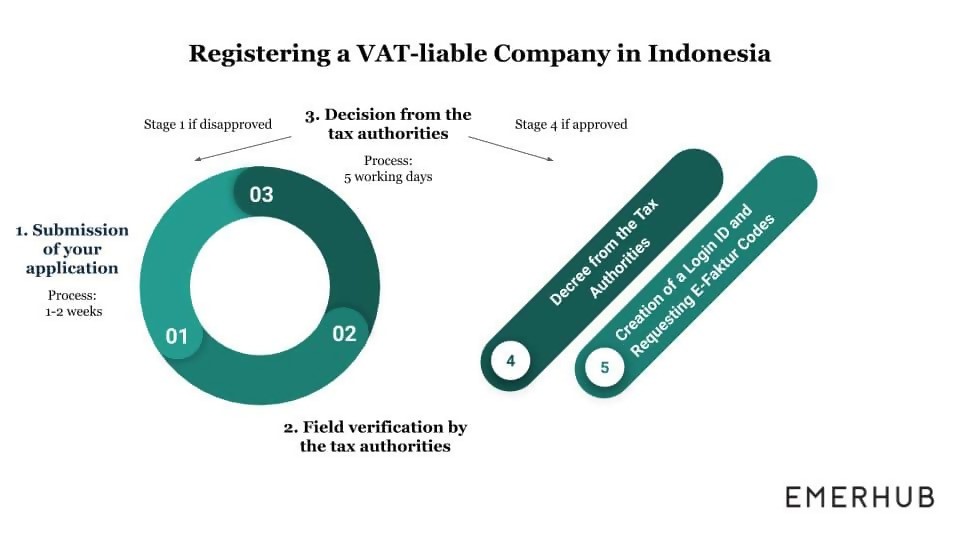

VAT Registration Process in Indonesia MAM Corporate Solutions

Value-added tax (VAT) in Indonesia is imposed on the provision of services or the transfer of taxable goods. Businesses are required to register for VAT once they reach an annual revenue of 4.8 billion rupiah (US$321,677). However, companies earning lower annual revenue can register voluntarily.

Registering a VATliable Company in Indonesia Indonesia Expat

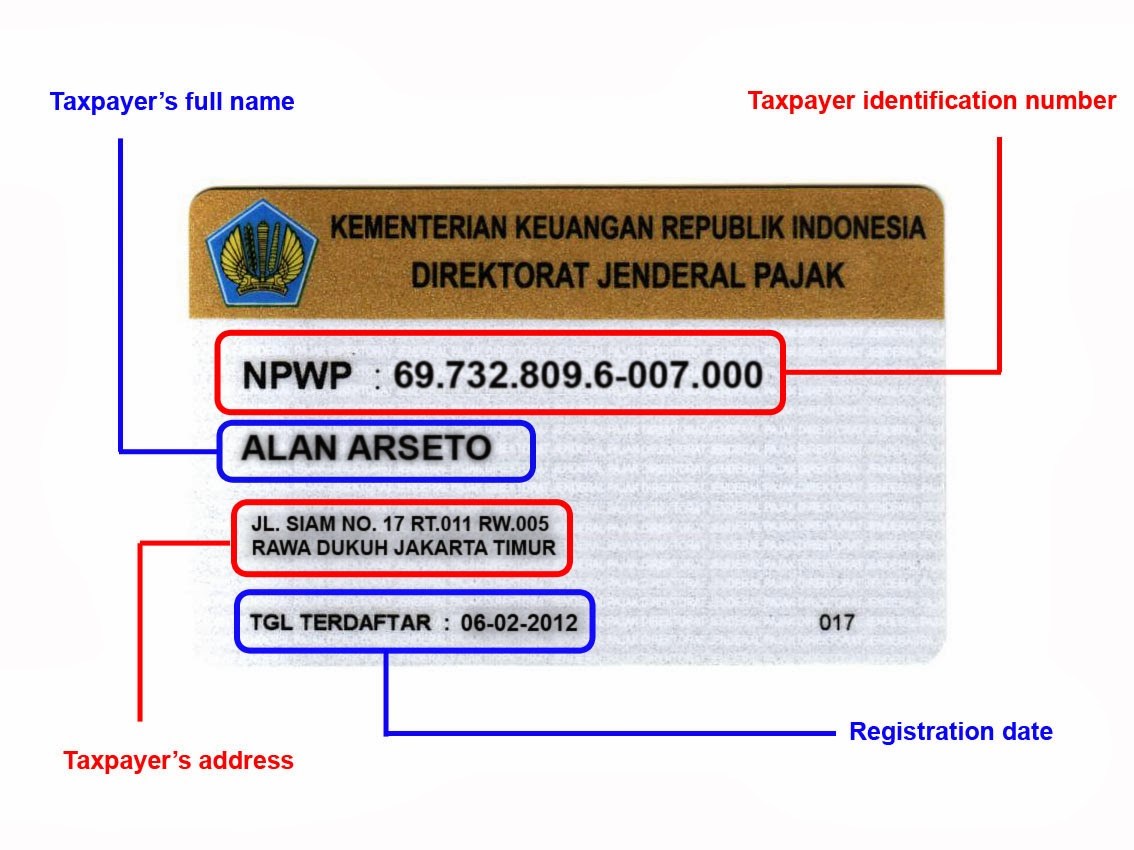

The Indonesian VAT registration threshold is IDR 4.8 billion sales per annum. Paper-based applications for VAT registrations should be submitted to the regional tax office of the business. Once registered, the tax payer is granted a Tax Identification Number (TIN) of 15 digits.

Indonesia VAT Everything You Need to Know Cekindo Indonesia

VAT rate is typically 10 percent applicable to the VAT base. Export of goods and service are 0 percent (there is certain limitation of export of services which is entitled to 0 percent VAT). 2. VAT registration and reporting. VAT obligations arise on VAT-able deliveries in excess of Rp 4.8 Billion per annum.

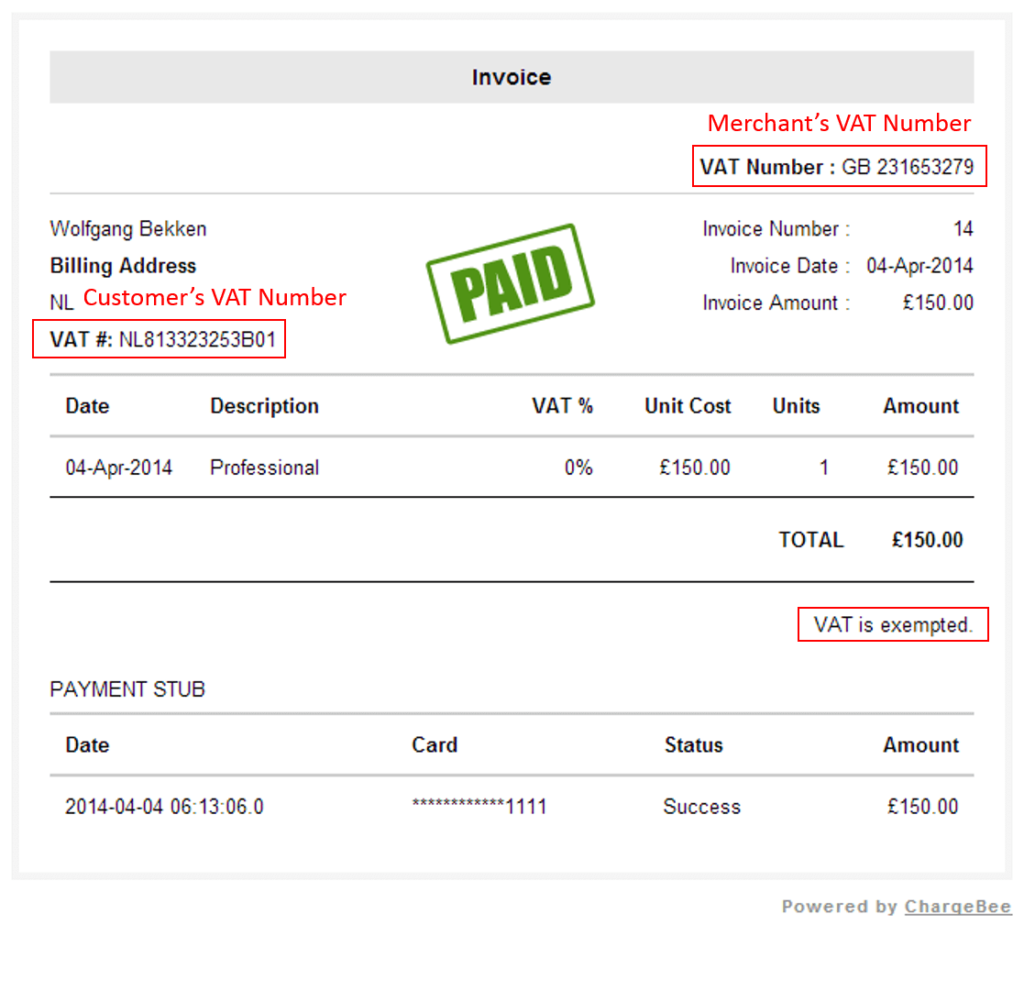

VAT Number Bookairfreight Shipping Terms Glossary

Indonesia before the tax office issues a deemed dividend (CFC) tax assessment letter. Provisions stipulated in MoF Regulation Number 107/PMK.03/2017 as amended by Regulation Number 93/PMK.03/2019 regarding CFC are still applicable as long as that they do not contradict PMK-18. Dividend income from offshore, PAT of a PE, and

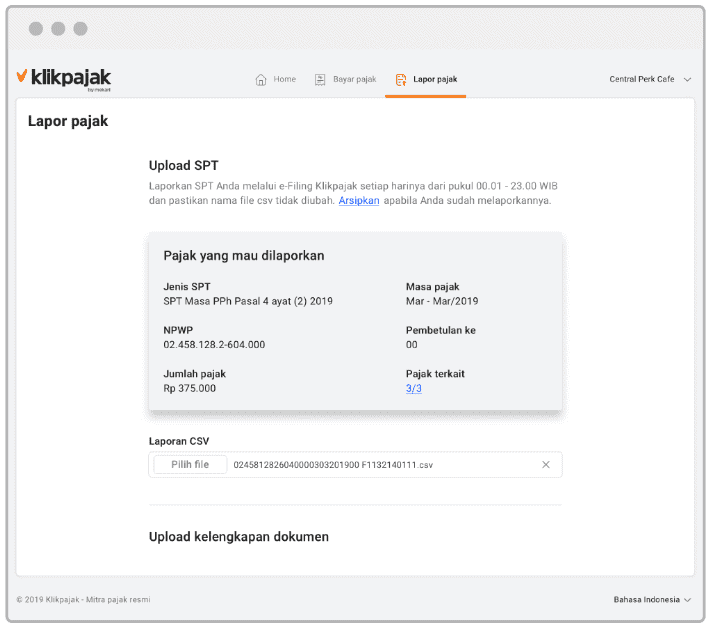

VAT Produk Digital Luar Negeri Berlaku Agustus 2020 Klikpajak

Value-Added Tax (VAT) is a tax imposed on most goods and services in the Indonesian Customs Area. In other words, a consumption tax is applied to each production stage until the final product sales. Therefore, Indonesia's VAT has impacts on both end consumers and businesses.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

VAT Number atau Nomor Pajak Value Added adalah nomor identifikasi pajak yang diberikan oleh pemerintah pada bisnis yang diwajibkan untuk mengumpulkan pajak nilai tambah dari pelanggan dan membayarkannya pada negara. VAT Number biasanya diberikan pada bisnis yang telah mencapai batas omset tertentu.

VAT Indonesia Calculator November 2023 VAT Rate is 10.

Enforced on most services and goods, the Indonesia Value-Added Tax (VAT) impacts both ends for consumers and businesses. If you intend to do business in the country, you need to be aware of how VAT is going to impact your business and your customers. Most people living in Indonesia consider VAT an affordable cost.

How to find a business's VAT number? Experlu

How do I enter my tax identification number? section VAT generally applies to all taxable supplies of goods and services made by Zoom to customers in Indonesia. Zoom will apply VAT if the "Sold To" contact address entered by the customer is in Indonesia.

VAT Produk Digital Luar Negeri Berlaku Agustus 2020 Klikpajak

VAT Number Adalah: Definisi, Dasar Hukum, dan Pemberlakuannya Terhadap Produk Digital VAT number adalah singkatan dari Value Added Tax atau Goods and Service Tax (GST) yang lebih dikenal sebagai Pajak Pertambahan Nilai (PPN) di Indonesia. PPN sendiri merupakan pajak yang dikenakan dalam setiap proses produksi maupun distribusi barang.

️ Cara Mendapatkan Tax Identification Number

Type of indirect tax: VAT. Standard rate: 10 percent. What supplies are liable to the standard rate? The delivery of taxable goods by an entity in Indonesia; the importation of taxable goods; the rendering of taxable services in Indonesia; utilization in Indonesia of intangible taxable goods from outside Indonesia; utilization of offshore taxable services in Indonesia; the disposal of fixed.

VAT Services in Indonesia 3E Accounting Indonesia

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

Tax Vat Vector Hd Images, Changes In Indonesia S Vat Tax Rate To 11

If your total sales in Indonesia remains below IDR 600.000.000, then you don't need to worry about VAT at all. Phew! But once your local sales do surpass IDR 600.000.000, then you may have to register for VAT and comply with all of the Indonesian rules around tax rate and collection, invoices, and filing returns.

VAT Number Atau PPN Pada Produk DIgital, Apa Pengaruhnya? idmetafora

a. number of users in Indonesia; b. amount of payments; c. amount of VAT collected; and d. amount of VAT settled to the government. The DGT can request for a detailed VAT report for each calendar year that should provide at least the following information: a. number and date of VAT collection slips; b. amount of payments; c. amount of VAT.

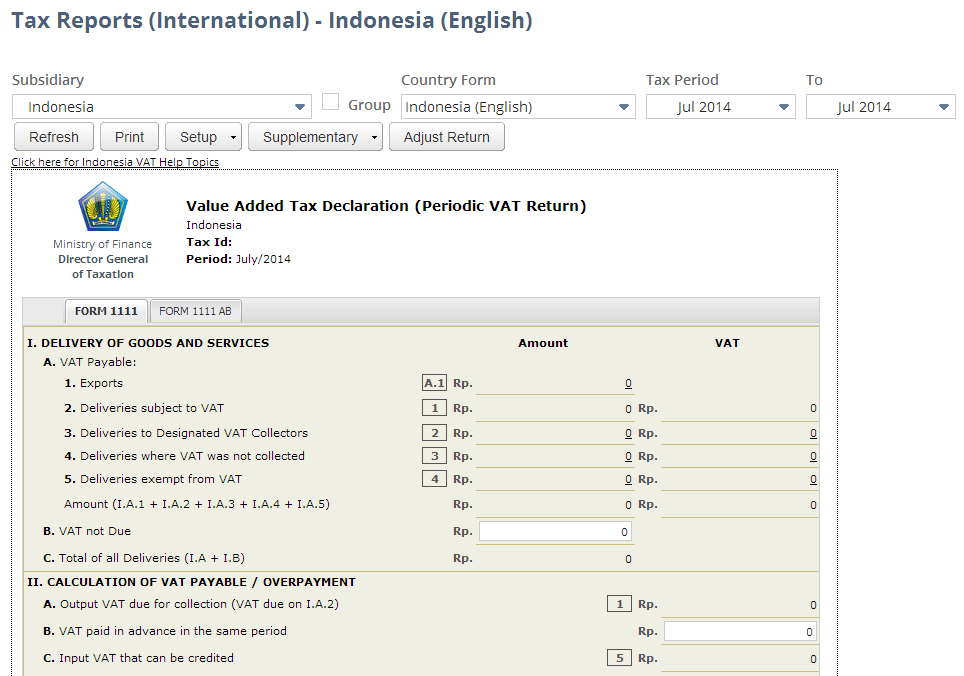

NetSuite Applications Suite Indonesia VAT Report

What is VAT tax in Indonesia? Value-Added Tax (VAT) is the tax imposed on most products and services in Indonesia. It is the consumption tax applied to each of the production stages up until the final stage, which is selling the product. VAT rates in Indonesia The VAT rates in Indonesia are as follows: